Eagle Pass City Council to Consider Third and Final Reading of Ordinance Designating Empire Industrial Park as a Tax Increment Reinvestment Zone and Other Related Agenda Items at May 7, 2024 Meeting

By: Ricardo E. Calderon, Eagle Pass Business Journal, Inc., Copyright 2024

The City of Eagle Pass, Texas City Council is scheduled to consider, discuss, and take possible action approving the third and final reading of a proposed ordinance designating Empire Industrial Park as “an area as a reinvestment zone for the tax increment financing purposes, pursuant to Chapter 311, as amended, Texas Tax Code; creating a Board of Directors for such zone; providing for an effective date and termination date; and containing findings and provisions related to the foregoing matters” according to Agenda Item No. 24 of the scheduled regular meeting on Tuesday, May 7, 2024, at 5:30 p.m. at City Council Chambers, 100 South Monroe Street, Eagle Pass, Texas.

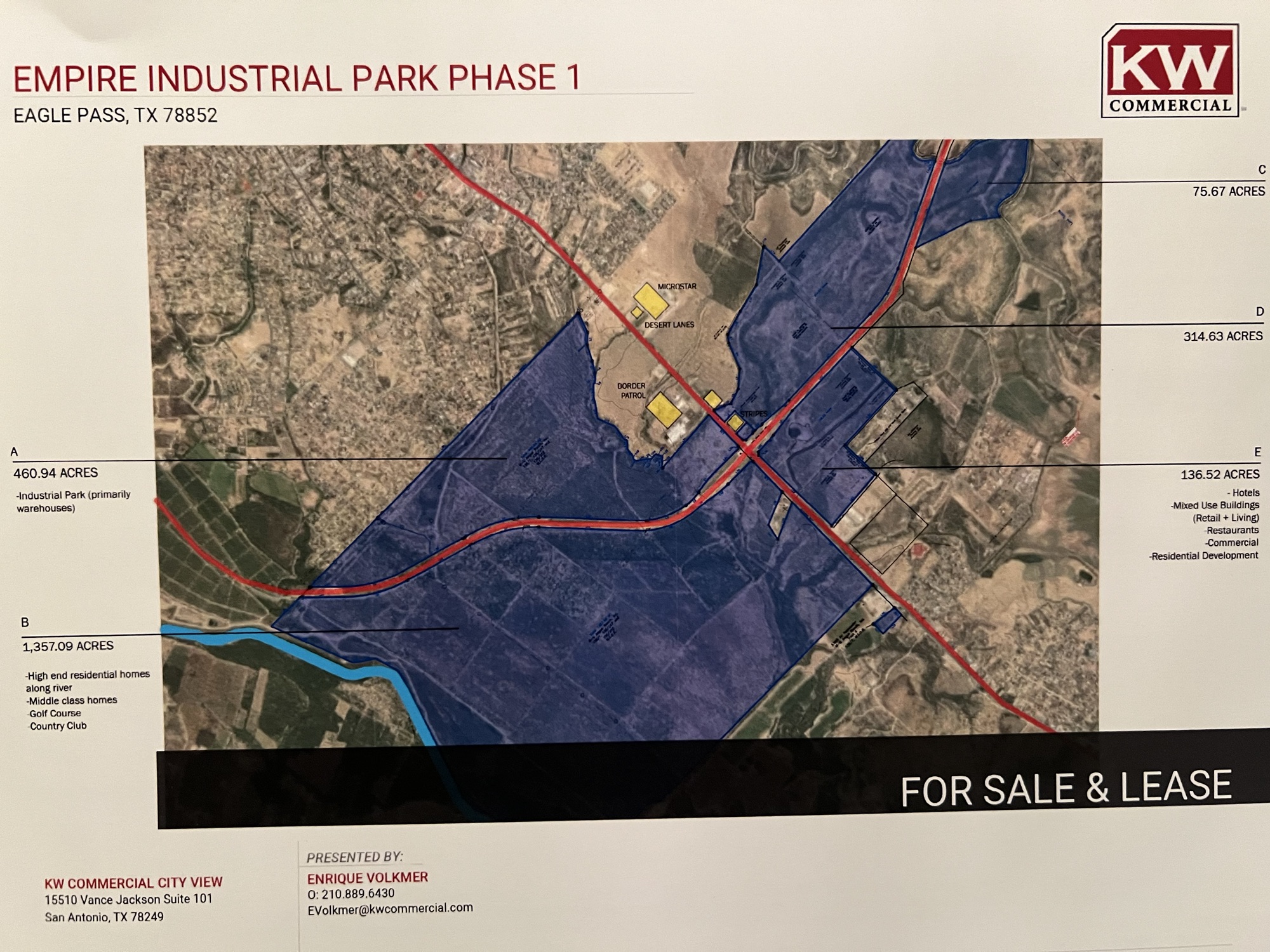

In addition to the City Council vote on Agenda Item No. 24 establishing Empire industrial Park as a Tax Increment Reinvestment Zone (TIRZ) by ordinance for financing purposes, the May 7, 2024 Agenda has four additional items calling for discussion and approval of related items, including Agenda Item No. 25 calling for “consideration for approval of a resolution of the City of Eagle Pass, Texas authorizing the execution of an inter-local agreement with Maverick County regarding participation in Tax Increment Reinvestment Zone Number One, City of Eagle Pass, Texas and containing other provisions related thereto; Agenda Item No. 26 calling for approval of a “Development Agreement between the City of Eagle Pass, Maverick County, and Developers responsible for developing certain property for the purpose of establishing the terms of development of real property consisting of approximately 461 acres known as Empire Industrial Park;” Agenda Item No. 30 calling for approval of “the Master Plan of Empire Industrial Park Units 1, 2, and 3;” and Agenda Item No. 31 calling for approval of the “Preliminary Plant of Empire Industrial Park Unit 1.”

Despite repeated public comments from many Eagle Pass citizens at previous City Council meetings, City Public Town Hall Meeting on the proposed project, Maverick County Commissioners Court, and the Maverick County Planning Department Public Town Hall meeting on the proposed project just held on Friday, May 3, 2024 at 4:30 p.m. requesting both City Council and Maverick County Commissioners Court not to approve the Tax Increment Reinvestment Zone because it will provide public financing through two City of Eagle Pass entities to be created specifically for this project of up to $114 million in certificates of obligations (bonds) for paying for the public improvements and infrastructure and both the City and County will waive 80 percent (80%) of the ad valorem property taxes of the increased value of the project ($540 million for Phase I and $1.7 Billion upon completion of entire project in 50 years or less) for 50 years, both the Eagle Pass City Council and Maverick County Commissioners Court are hell bent on approving this critical public ad valorem tax jewel to the real estate developers and investors while the rest of taxpayers do not receive the same treatment for their real property or businesses.

One local citizen described this proposed establishment and designation of the Tax Increment Reinvestment Zone as “the greatest transfer of public wealth in the history of the City of Eagle Pass.”

The Tax Increment Reinvestment Zone called Empire Industrial Park is a 2,300 acres real property owned by Dr. Sergio Zamora and wife, Linda Zamora, and Beyer Junfin and Sonia Valdez-Junfin located at the intersection of Loop 480 and El Indio Highway (FM 1021) in southern Maverick County, Texas, which the City of Eagle Pass has annexed into the City Limits and causing the City limits to grow by 38 percent (38%) from its previous 6,000 acres city limits boundaries. The property formerly was owned the Quirk Family of Omaha, Nebraska who operated it as a pecan orchard and cattle-raising farm known as Rosetta Farms. The real property is currently appraised as agricultural, which has the lowest ad valorem tax rate, and is prime real property—not blighted nor distressed property within the City.

At a previous City Council meeting in 2023, Sonia Valdez Junfin publicly told the Eagle Pass City Council that they have the investors and the money to develop Empire Industrial Park, but that they were waiting first to see if the City Council would approve the Tax Increment Reinvestment Zone and the Public Utility Improvement District so these two newly-created city-owned entities could then issue certificates of obligations (bonds) to reimburse or pay them (developers) for the public improvements and infrastructure of the project. In other words, why go out to borrow money for the project in the private market when the two City-owned entities being created will simply issue bonds to pay for the public improvements for the entire 2,300 acres with the credit of the City of Eagle Pass taxpayers.

The $114 million bonds being requested in the written proposals will be paid by the people or businesses who buy a real property within the project through the increased ad valorem property taxes to pay off the bonds while the City taxpayers will only receive 20 percent (20%) of the increased ad valorem taxes attributed to the increased appraised value for the next 50 years. After 50 long years, Eagle Pass taxpayers will commence receiving 100 percent (100%) of the ad valorem taxes attributed to the increased appraised value.

At another City Council meeting in 2023, another of the developers confided in a citizen attending the meeting that they planned to create their own companies who would do the public improvements and infrastructure for the project so they would get reimbursed or paid from the $114 million in bond monies issued by the two newly-created City-owned entities (TIRZ and PID). In other words, the developers would also profit from doing the public improvements themselves with their own companies. Once the public improvements are done and paid for with City-issued bonds, the appraised value of the project would skyrocket.

Growing the City limits by up to 38 percent in land mass, properties, streets, buildings, parks, and services, will require significant municipal services that the City of Eagle Pass will have to provide to this new area of development such as police protection, fire protection, ambulance services, water and trash collection services, parks and recreation, and many new City employees to handle the growth—requiring City funding to pay for these increased services. In addition, new schools, medical facilities, public parks, and all types of services will be required to handle the growth and traffic within the project and surrounding area.

Even if the City collects new sales taxes, hotel occupancy room taxes, and the 20 percent of the increased appraised value of ad valorem taxes from this project, they will not be sufficient to pay for the increased costs for the City, County, and other public entities to provide new services. While the City of Eagle Pass has many neighborhoods, streets, drainage issues, and other municipal services needs within the inner-city limits, the City and its administration will be focusing and have its hands full on developing this new real estate development that is four to six miles away from the inner-city neighborhoods.

While this project is hailed as a “Win, Win” for the City, County, and the real estate investors, nobody has put a pencil to paper to calculate exactly how many tens or hundreds of millions of ad valorem tax dollars the City and County will waive (lose) for the next 50 years required of this project by establishing the TIRZ and PID City-owned entities. This project has been worked on for almost two years by the real estate investors and the City administration, but the citizen taxpayers were not publicly informed of this until a few months ago in mid-2023. Furthermore, the City taxpayers have not been publicly informed by the City Council and Administration what are the exact details of this project and what are the terms of the Development Agreement between the City and Investors, the Master Plan of the Empire Industrial Park, and the terms of the bonds that are to be issued by the two City-owned entities to be created specifically for this project.

Most importantly, neither the City, County nor the real estate investors have asked the City taxpayers if they approve of this project and provided them with genuine open and transparent information. The project has been presented like a cheerleading camp with chants of “it’s a win, win situation for the City, County, and investors.” Nobody has asked the taxpayers what do they think about this project or want from this project. However, the City taxpayers are the most important people in all of this project because it is their City-bond credit worthiness that is going to bankroll the up to $114 million bonds to pay for all of the public improvements, plus many more tens of million dollars for the next 50 years with the increased City costs to provide the increased city-services from this real estate development. Most City taxpayers will not be able to afford to purchase a real property in this new high-priced, luxury real estate development. But they sure want their City-bond credit worthiness to finance it. How will these $114 million bonds affect the City credit worthiness for future City projects.

One taxpayer stated economic development is welcomed in Eagle Pass and Maverick County with open arms, but the real estate developers must understand that they must obtain their own financing or in the private market instead of public taxpayers bankrolling them.

This publication reported in 2023 that this project if approved would create a legal precedent for more real estate investors to seek the creation of additional TIRZs and PIDS by the City of Eagle Pass for future developments. At a City Council meeting earlier in 2024, City Administration reported that they have already received a second request for a new TIRZ project along Patsy Winn Blvd. by another real estate investor.

Recently, in April 2024 a Travis County state district judge ordered the City of Austin, Texas that a tax increment reinvestment zone they did was a misuse of state law because the proposed real estate development was not a blighted nor distressed property within the city, establishing a legal precedent that City-created TIRZs may be successfully challenged in a state district court as being a misuse of state law if the property does not satisfy the legal requirements of state law.

Eagle Pass taxpayers are welcomed to attend the City Council meeting on Tuesday, May 7, 2024, at 5:30 p.m. to express their opinion on these agenda items and others. Citizens are allowed three minutes to speak during the Citizens Communication agenda of the meeting.