Texas Border Economy March 2023

Joshua Roberson and Rajendra Patidar (May 31, 2023)

Economic indicators along the border showed mixed responses in March. Employment numbers increased modestly in each of the border Metropolitan Statistical Areas (MSAs), corroborated by a slight increase in unemployment rates and unemployment claims. Both commercial and residential construction has improved. Net trade values were down, and the gap between imports and exports led to a persistent trade deficit.

Housing demand conditions are slowly improving, showing signs of stabilization. Both commercial and residential construction are spurring and attracting new investments. Inflation cooled in March as the Federal Reserve’s interest rate increases showed more impact. Data showed that while inflation is still well above the Fed’s inflation target, it is at least showing continuing signs of decelerating.

Economy

According to the Dallas Fed’s Business-Cycle Indexes, which are measures of general economic output, March revealed mixed progress for growth. At the metro level, El Paso and Laredo reported an improvement in business activity as their seasonally adjusted annualized growth index went up by 2.2 and 1.4 percent, respectively. Meanwhile, the metric shrank by 2.6 percent in Brownsville and increased by 1.2 percent in McAllen. The economic growth in the first quarter of this year has been sluggish.

Pedestrian and personal vehicle crossings at the border went up by 16.3 percent and 12.6 percent, respectively. Although border crossings have decreased in the past couple months, they are significantly higher than March 2022 levels. Most major ports, including Hidalgo, Brownsville, Laredo, and Rio Grande City, have recorded a continuous increase in crossings with El Paso being the exception where the recovery has been stagnant.

Overall, border nonfarm employment added 1,000 positions due to hiring expansion in McAllen-Edinburg-Mission (Table 1). The first quarter had robust employment growth, particularly in the McAllen-Edinburg-Mission region, where the professional and business services and trade and transportation industries have emerged as the most significant contributors to job creation. Meanwhile, El Paso, the largest MSA along the border, reported job loss in 1Q2023.

Overall unemployment rate averaged around 5.3 percent in March. Joblessness in Brownsville increased by one percentage point, and El Paso’s metric rose by two percentage points. McAllen-Edinburg-Mission’s and Laredo’s unemployment remained unchanged at 6.3 and 4.2 percent, respectively. The labor force participation rate ticked down statewide, while weekly unemployment claims declined across border areas.

Average hourly earnings fluctuate monthly, but the overall trend shows earnings have increased substantially post pandemic. Even with this growth, ongoing inflationary pressures have eroded purchasing power and meaningful gains for the labor force. Nominal wages remained unchanged and averaged $22.73 in El Paso and $19.54 in McAllen in 1Q2023. Hourly wages in Laredo rose to $21.14 in March, while wages in Brownsville have been falling consecutively for two months and metric fell to $18.02 in March.

On the southern side of the border, Mexican manufacturing and maquiladora1 is struggling to generate new employment opportunities (Table 2). Although the first month of the year showed signs of economic recovery, employment numbers for February suggest the pace of recovery may be slower than anticipated. More than 15,000 jobs were lost in 4Q2022 due to reduced demand conditions and decrease in productionmanufacturing facilities.

Global supply chain pressures decreased further in March, as indicated by the Global Supply Chain Pressure Index (GSCPI). The GSCPI’s recent movements suggest global supply chain conditions have largely normalized after experiencing temporary setbacks around the turn of the year.

In the currency market, the peso per dollar exchange rate averaged $18.39.2 After adjusting for inflation, the metric decreased over the month, revealing gains for Mexican importers. March data showed a successive improvement in the health of the Mexican manufacturing industry, as companies are slow in hiring additional workers in tandem with new business gains, according to S&P Global Mexico Manufacturing PMI.

The Texas-Mexico border processes more than $500 billion trade annually. Trade across all the major ports surged, with both total imports and exports reporting an increase. Despite growth in trade, the gap between total imports and exports remains higher, resulting in lower net trade values. The net border trade value decreased by 35 percent in March, resulting in a wider gap between imports and exports. At the metropolitan level, only Brownsville and El Paso exports were higher than imports. The trade at El Paso port, which drastically reduced since 2021, is now gaining momentum as trade improves and crossings increase. In a broader context, the decline in real effective exchange rate (REER) for the second consecutive month reveals the softening of the U.S. dollar relative to its 2022 peaks.

Real Estate

Border metros offer a variety of business and investment opportunities in different sectors such as trade, transportation, and logistics. Some segments of construction activity have risen due to investments in retail space, healthcare, and warehouses and because of recovering housing demand in recent months. Changes in residential and nonresidential construction values varied across border areas. Commercial construction values in McAllen-Edinburg-Mission grew by 136 percent (year-over-year), and it is expected that this year’s dollar values will be significantly higher than last. Housing market disruptions had a negative impact on the growth of residential construction by the end of 2022, but this year’s residential construction data for 1Q2023 shows an expansion in the construction of new homes.

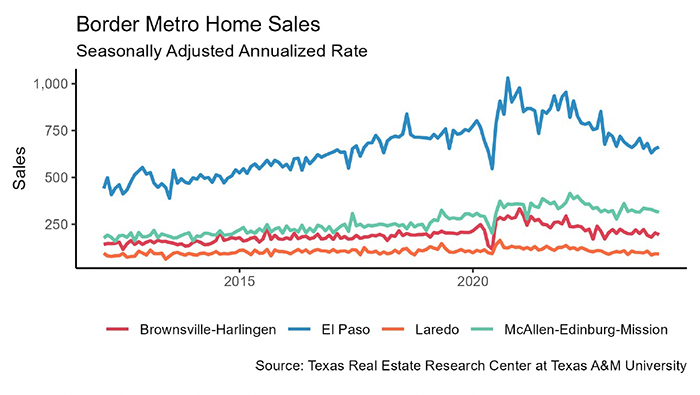

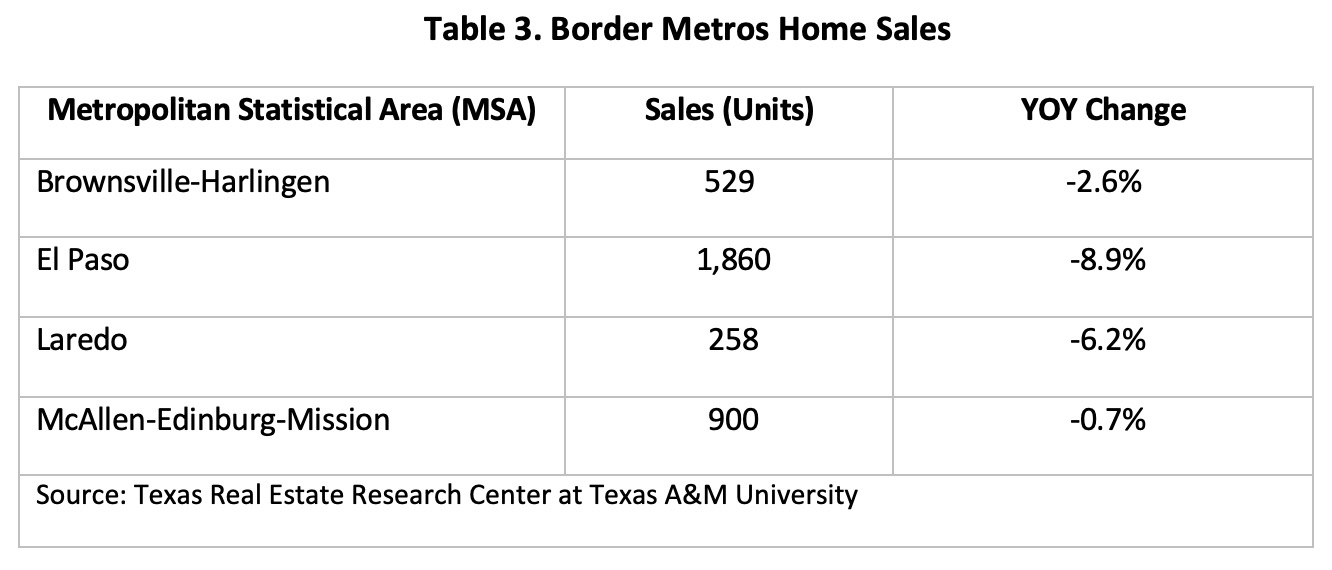

Overall housing sales were down by 3.1 percent in March after seasonal adjustments, though monthly changes differed across metros. The housing demand was disrupted last year, but first quarter sales data indicated stability (Table 3).

Housing sales have been volatile in recent months primarily due to the market’s dependency on mortgage rates. Freddie Mac’s 30-year fixed rate was 7 percent in March. Consumer buying behavior has changed over the last three quarters with concerns about rising mortgage rates and high inflation.

The slowdown in growth of housing sales in recent months led to increased months of inventory (MOI) along the border, though the metric remained much lower than the six-month benchmark. Rio Grande Valley’s available months of inventory averaged around 4.1 months in both McAllen and Brownsville. El Paso’s declining sales activity and an uptick in new listings pushed March’s average MOI to 2.3 months. Laredo’s metric remained unchanged at 3.3 months. These increases indicate inventory is growing primarily due to a decrease in home sales and an increase in listings.

Average days on market (DOM) in March, varied across the border, but the metric was higher than year-ago levels. The metric elevated in McAllen (66 days) but was unchanged in Brownsville (61 days). Meanwhile, El Paso’s DOM rose to 61 days (about two months), and Laredo’s DOM moved down to 42 days (about one-and-a-half months).

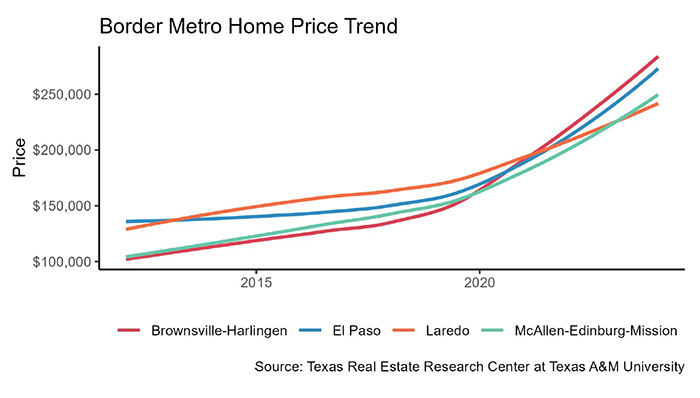

The dynamic housing demand has shown mixed responses in median prices of houses in border metros. Seasonally adjusted median home prices grew across border regions in March (Table 4). Brownsville-Harlingen (Cameron County), which reported soaring housing prices during 2021-22, has seen a continuous decline in prices during 1Q2023. The border region’s housing market is known for its affordability, a factor that has attracted many buyers from other areas.

While the existing home market has been disrupted in recent months, the new-home market has shown signs of growth. New permits were down in the last two quarters of 2022, but recent growth indicates a possible recovery in housing markets. Border metros reported a rise in single-family housing construction permits in 1Q2023. A total of 743 permits were issued in all border metros, where McAllen (Hidalgo County) alone added 360 permits.

1 Mexican manufacturing and maquiladora employment are generated by the Instituto Nacional de Estadística y Geografía. Its release typically lags the Texas Border Economy by one month.

2 The real peso per dollar exchange rate is inflation adjusted using the Texas Trade-Weighted Value of the Dollar.